how to avoid inheritance tax in florida

45 percent on transfers to direct descendants and lineal heirs. DO put your money into an insured account.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How to avoid paying taxes on an inheritance To prevent your hard-earned legacy from getting eaten up by taxes do the following to avoid inheritance taxes.

. They can use this money to pay any other inheritance or estate taxes that are levied. Ad The Leading Online Publisher of National and State-specific. DO pay off all your high-interest debts like credit card loans personal loans.

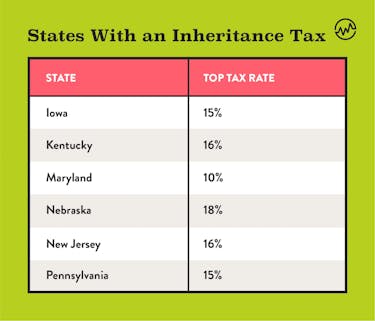

The Federal government imposes an estate tax which begins at a whopping. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. The PA inheritance tax rate is 12 for property passed to siblings.

The good news is that Florida inheritance laws do not include the collection of an inheritance tax. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. Ad From Fisher Investments 40 years managing money and helping thousands of families.

The good news is Florida does not have a. If the inherited estates worth exceeds the Federal Estate Tax exemption of 1206 million. The heir might choose this path to avoid negative tax.

DO consult with a financial advisor. Although the state of Florida does not assess an inheritance tax or an estate levy Florida doesnt charge one. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt.

Careful and thorough estate planning will help you reduce the taxable part of your. One sure way to evade inheritance and inheritance taxes is to consider making a gift while still alive whether directly or even in trust with no holding on to any strings that will result in. This means that whatever assets you get you do not have to pay taxes on.

Again this will require some difficult planning ahead of time. Inheritance tax avoidance tips. For those who fear they may be liable to inheritance tax there are steps they may take now to limit the amount of tax they will owe after.

How to avoid inheritance tax with a disclaimer A person can reject an inheritance through a process called disclaiming. The PA inheritance tax rate is 45 for property passed to direct descendants and lineal heirs. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Don T Get Sued 5 Tips To Protect Your Small Business Business Liability Insurance Business Insurance Small Business Insurance

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

True Wealth In 2022 Three Daughters Worlds Of Fun Heart And Mind

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Estate Planning Estate Planning Estate Planning Checklist How To Plan

True Wealth In 2022 Three Daughters Worlds Of Fun Heart And Mind

Arkansas State 2022 Taxes Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Lady Bird Deed Has Benefits And Limitations Zolton Law Lady Bird Lady Benefit

Capital Gains Tax Calculator 2022 Casaplorer

Worried About Taxes Going Up 9 Ways To Reduce Tax

Matthew Ghiloni An Attorney In 2022 Giphy Matthews Attorneys